Halifax More Than Just a Bank

Halifax, a well-known name in UK banking, also offers a range of insurance products, including car insurance. While it’s a familiar brand, it’s crucial to understand that Halifax doesn’t underwrite these policies directly. Instead, it acts as a broker, offering policies from a panel of insurers. This means your Halifax car insurance policy is actually backed by another company.

Halifax Car Insurance: What to Expect

Halifax provides standard car insurance options, including third-party only, third-party fire and theft, and comprehensive cover. The policies come with additional benefits like breakdown cover, legal protection, and guaranteed replacement car, which can be added for an extra cost.

Customer Feedback A Mixed Bag

Customer reviews for Halifax car insurance present a mixed picture. While some customers praise the convenience of managing their insurance alongside other financial products, others have expressed significant dissatisfaction.

Common complaints include:

Customer service issues: Many customers report difficulties in contacting Halifax, long wait times, and problems resolving claims.

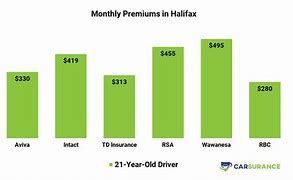

Price concerns: While prices can be competitive, it’s essential to compare quotes from multiple providers to ensure you’re getting the best deal.

Positive reviews often highlight the ease of managing policies online and the range of cover options available.

Comparing Halifax to Other Insurers

To make an informed decision, it’s crucial to compare Halifax car insurance with other providers. Consider factors such as:

Price: Compare quotes from multiple insurers to ensure you’re getting the best value.

Cover levels: Ensure the policy meets your specific needs.

Customer reviews: Check online reviews to gauge customer satisfaction.

Claims process: Understand how claims are handled and the insurer’s reputation for settling claims fairly.

Tips for Choosing a Car Insurer

Get multiple quotes: Compare prices and cover from different providers.

Read the policy documents carefully: Understand the terms and conditions of the policy.

Consider your needs: Choose a policy that matches your specific requirements.

Check for discounts: Take advantage of any available discounts, such as no claims bonus or multi-car discounts.

Review your policy regularly: Ensure your cover remains adequate as your circumstances change.

By carefully considering these factors and comparing different options, you can find the best car insurance deal to suit your needs.

FAQS

What is Halifax Car Insurance?

Halifax, a well-known bank in the UK, also offers car insurance policies. It’s important to note that Halifax doesn’t underwrite these policies themselves but acts as a broker, offering products from a panel of insurers. This means you’ll get a Halifax policy, but the actual cover is provided by another company.

What are the different types of car insurance offered by Halifax?

Halifax provides a range of car insurance options to suit different needs, including:

Third-party only: Covers damage caused to other people’s vehicles and property.

Third-party, fire and theft: Covers damage caused to other people’s vehicles and property, as well as fire and theft of your own car.

Comprehensive: Covers damage to your own car, as well as damage to other people’s vehicles and property.

What are the pros and cons of Halifax Car Insurance?

Pros:

Convenience: If you’re already a Halifax customer, managing your car insurance alongside other financial products can be convenient.

Range of options: Halifax offers different levels of cover to suit various needs.

Cons:

Customer service: Halifax has received criticism for its customer service, with many complaints about long wait times and issues resolving claims.

Price: Prices can be competitive, but it’s essential to compare quotes from multiple providers to find the best deal.

How does Halifax car insurance compare to other providers?

It’s crucial to compare quotes from multiple insurers to find the best deal for your specific needs. Consider factors such as price, cover levels, customer reviews, and claims history.

What do customers say about Halifax car insurance?

Customer reviews for Halifax car insurance are mixed. While some customers have reported positive experiences, others have complained about issues with claims processing and customer service. It’s essential to read a variety of reviews to get a balanced perspective.

How can I get a quote for Halifax car insurance?

You can get a quote for Halifax car insurance online, over the phone, or by visiting a Halifax branch. It’s essential to provide accurate information about your vehicle, driving history, and desired level of cover to get an accurate quote.

What happens if I need to make a claim with Halifax car insurance?

The claims process can vary, but generally, you would need to contact Halifax to report the claim. They will guide you through the necessary steps and provide information on required documentation.

To read more click here