The Bangladeshi Taka (BDT) is the official currency of Bangladesh and plays a significant role in the country’s economy. The exchange rate of the Taka against major currencies, especially the US Dollar (USD), can greatly influence various economic activities, including trade, investment, and remittances. In this article, we will explore the factors that affect the Taka rate, current trends, and practical tips for individuals and businesses dealing with currency exchange.

What is the Taka

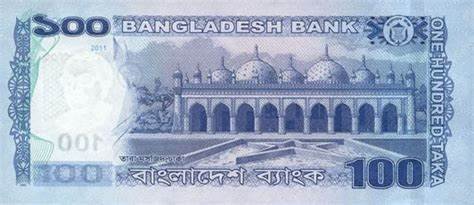

The Taka was introduced in 1972, replacing the Pakistani Rupee as the official currency of Bangladesh following its independence. Symbolized as “৳” and abbreviated as BDT, the Taka is divided into 100 poisha. The currency is issued and regulated by the Bangladesh Bank, the country’s central bank.

Current Trends in Taka Rate

The Taka rate against the USD and other major currencies has experienced fluctuations in recent years. Understanding the current exchange rate is crucial for various stakeholders, including importers, exporters, and travelers.

Historical Context

Historically, the Taka has faced challenges due to inflation, trade deficits, and economic instability. Factors such as political developments, natural disasters, and global economic trends have also influenced the currency’s strength. Over the years, the Taka has generally depreciated against the Dollar, reflecting broader economic challenges.

Factors Influencing the Taka Rate

Several key factors affect the Taka rate, including:

Economic Indicators

Economic indicators play a significant role in determining currency strength. Important metrics include:

Gross Domestic Product (GDP): A growing GDP indicates a robust economy, potentially strengthening the Taka.

Inflation Rates: High inflation in Bangladesh can erode the Taka’s value, making it weaker against other currencies.

Unemployment Rates: High unemployment can signal economic distress, affecting currency value negatively.

Trade Balance

Bangladesh has a diverse economy that relies heavily on exports, particularly in textiles and garments. A trade surplus can bolster the Taka’s value, while a trade deficit may lead to depreciation. Monitoring trade data is crucial for understanding the Taka’s performance.

Foreign Remittances

Remittances from Bangladeshis working abroad constitute a significant portion of the country’s foreign exchange earnings. High levels of remittances can support the Taka, whereas a decline in remittances may adversely affect its value.

Monetary Policy

The Bangladesh Bank influences the Taka rate through its monetary policy. Changes in interest rates, foreign exchange reserves, and interventions in the currency market can all impact the Taka’s value. The central bank often aims to stabilize the currency and control inflation.

Political Stability

Political events and stability significantly impact investor confidence. A stable political environment can strengthen the Taka, while political unrest or uncertainty can lead to currency depreciation. Investors tend to shy away from markets perceived as risky, leading to capital flight and weaker currency.

Global Economic Trends

Global economic conditions, including the performance of major economies, can influence the Taka rate. For example, fluctuations in oil prices, changes in global trade policies, and economic downturns in key trading partners can affect Bangladesh’s economy and its currency.

Current Exchange Rate: Taka to Major Currencies

The exchange rate of the Taka against major currencies, especially the USD, is a key focus for businesses and individuals. As of the latest data, the Taka is typically quoted in the range of 85 to 100 BDT per USD, though this can vary. It’s important to check reliable financial sources for real-time exchange rates.

How to Exchange Taka

For individuals and businesses looking to exchange Taka, there are several options available:

Banks

Most banks in Bangladesh offer currency exchange services. While banks generally provide reliable rates, they may not always be the most competitive. It’s advisable to compare rates among different banks before proceeding.

Currency Exchange Bureaus

Currency exchange bureaus often offer more favorable rates compared to banks. However, it’s essential to ensure that these bureaus are licensed and reputable to avoid scams.

Online Platforms

Digital currency exchange platforms have become increasingly popular, offering competitive rates and convenience. However, always check for hidden fees and ensure the platform is secure.

ATMs

Some ATMs in Bangladesh allow for cash withdrawals in foreign currencies. However, be cautious of transaction fees and unfavorable exchange rates associated with ATM withdrawals.

FAQs

What is the Current Taka Rate?

The Taka rate fluctuates regularly due to market conditions. To find the most accurate and up-to-date exchange rate, it is best to consult reliable financial news websites, currency converter apps, or financial institutions. Rates can vary depending on the provider and market conditions.

How Can I Exchange Taka?

You can exchange Taka through several methods:

Banks: Most banks in Bangladesh offer currency exchange services. While banks are generally reliable, it’s advisable to compare rates among different banks to find the best deal.

Currency Exchange Bureaus: These often provide competitive rates and can be a good option for cash exchanges. Ensure you use licensed and reputable bureaus to avoid scams.

Online Platforms: Many digital currency exchange services are available, often offering better rates compared to physical locations. Always verify the security of these platforms before making transactions.

ATMs: Some ATMs in Bangladesh dispense foreign currencies. However, be aware of potential transaction fees and unfavorable exchange rates associated with ATM withdrawals.

Are There Fees Associated with Currency Exchange?

Yes, currency exchange can come with various fees, including:

Transaction Fees: A fee charged for the exchange process.

Exchange Rate Markup: This is the difference between the market rate and the rate you receive.

Service Charges: Additional fees may apply, especially with online platforms or ATMs.

Always inquire about these fees before proceeding with any currency exchange to ensure transparency.

What is the Future Outlook for the Taka Rate?

Predicting the future Taka rate involves analyzing economic trends and geopolitical factors. While Bangladesh’s economy has shown growth potential, ongoing challenges such as inflation and trade imbalances will influence the Taka’s performance. Staying updated on economic indicators and government policies will help you understand potential changes in the Taka rate.

Understanding the Taka rate is essential for anyone involved in financial transactions in Bangladesh. By staying informed about the factors influencing the Taka, monitoring exchange rates, and exploring various exchange methods, individuals and businesses can make more informed decisions and optimize their currency exchange experience.

To read more, click here