In today’s globalized world, individuals and businesses often need to transfer money across borders, making currency conversion an essential part of international transactions. Wise, formerly known as TransferWise, has emerged as a popular platform for transferring money internationally at lower costs. This article explores Wise conversion, its benefits, how it works, and why it has become a favored choice for people seeking affordable and transparent currency exchange.

What is Wise Conversion?

Wise conversion refers to the process of exchanging currencies through the Wise platform. Unlike traditional banks that often charge high fees and apply unfavorable exchange rates, Wise offers a more transparent, low-cost method of currency conversion. The platform uses the real mid-market exchange rate—the rate you see on Google or financial news sites—without inflating it to make a profit, which is a common practice among banks and traditional money transfer services.

Since its inception in 2011, Wise has focused on helping individuals, freelancers, and small businesses save money when transferring funds internationally. By using peer-to-peer technology and removing the need for international transfers between banks, Wise has redefined the way people exchange currencies.

How Does Wise Conversion Work?

Wise works by using a unique peer-to-peer system to facilitate currency exchange. Here’s how it works:

- Setting Up an Account: To start using Wise, users need to sign up for a free account. This can be done online through their website or mobile app. Users will need to provide basic information, such as name, email, and identity verification.

- Initiating a Transfer: After setting up an account, users can initiate a money transfer or currency conversion by entering the amount they want to send and selecting the currencies involved (e.g., USD to EUR or GBP to AUD). Wise provides an estimate of the fees and the exact amount the recipient will receive.

- Funding the Transfer: The user then funds the transfer via bank transfer, credit card, debit card, or other supported payment methods. Wise collects the money in the sender’s local currency.

- Local Distribution: Instead of sending the money across borders, Wise uses its local bank accounts to pay out the recipient in their currency. This system ensures that funds are not subject to international transfer fees, which makes the process quicker and more cost-effective.

- Mid-Market Rate: Wise uses the real mid-market exchange rate, the fairest rate available, and charges a small transparent fee, often a fraction of what traditional banks charge.

This system allows for fast transfers at much lower costs than traditional methods. Users receive notifications on their transfer’s progress, ensuring transparency and reliability throughout the process.

Benefits of Using Wise for Currency Conversion

Wise conversion offers several key advantages over traditional methods, which have made it an attractive option for users around the world:

1. Low Fees

One of the main reasons people turn to Wise for currency conversion is the low fees compared to banks and other money transfer services. Traditional financial institutions often inflate exchange rates and add hidden fees, making the transfer cost significantly higher than expected. Wise charges a flat, transparent fee based on the amount transferred, which is clearly shown before initiating the conversion. This upfront transparency is highly appreciated by users, as there are no surprises or hidden charges.

2. Real Exchange Rate

Wise uses the real mid-market exchange rate, the same rate you would find on Google or major financial news sites. This rate is free from the typical markups that banks apply, meaning users get the fairest possible value for their money. This feature sets Wise apart from many competitors, where exchange rates are manipulated to generate higher profits.

3. Speed and Efficiency

Because Wise operates using local bank accounts, transfers are often completed faster than traditional bank transfers, which can take several days. While the speed of a transfer depends on the currencies involved and the countries of the sender and recipient, many Wise transactions are completed within one or two business days. The absence of middlemen like correspondent banks reduces delays and improves the efficiency of currency conversion.

4. Global Reach

Wise allows users to send and receive money in more than 50 currencies and over 80 countries, making it a versatile option for individuals and businesses engaged in international transactions. Whether you’re sending money to family abroad, paying freelancers, or settling business invoices, Wise provides a cost-effective solution.

5. User-Friendly Platform

Wise’s platform is designed with user convenience in mind. Both the website and mobile app offer a seamless, intuitive experience that makes setting up transfers quick and easy. Users can track their transfers in real-time, receive notifications, and manage their accounts from anywhere.

Wise vs. Traditional Banks: A Cost Comparison

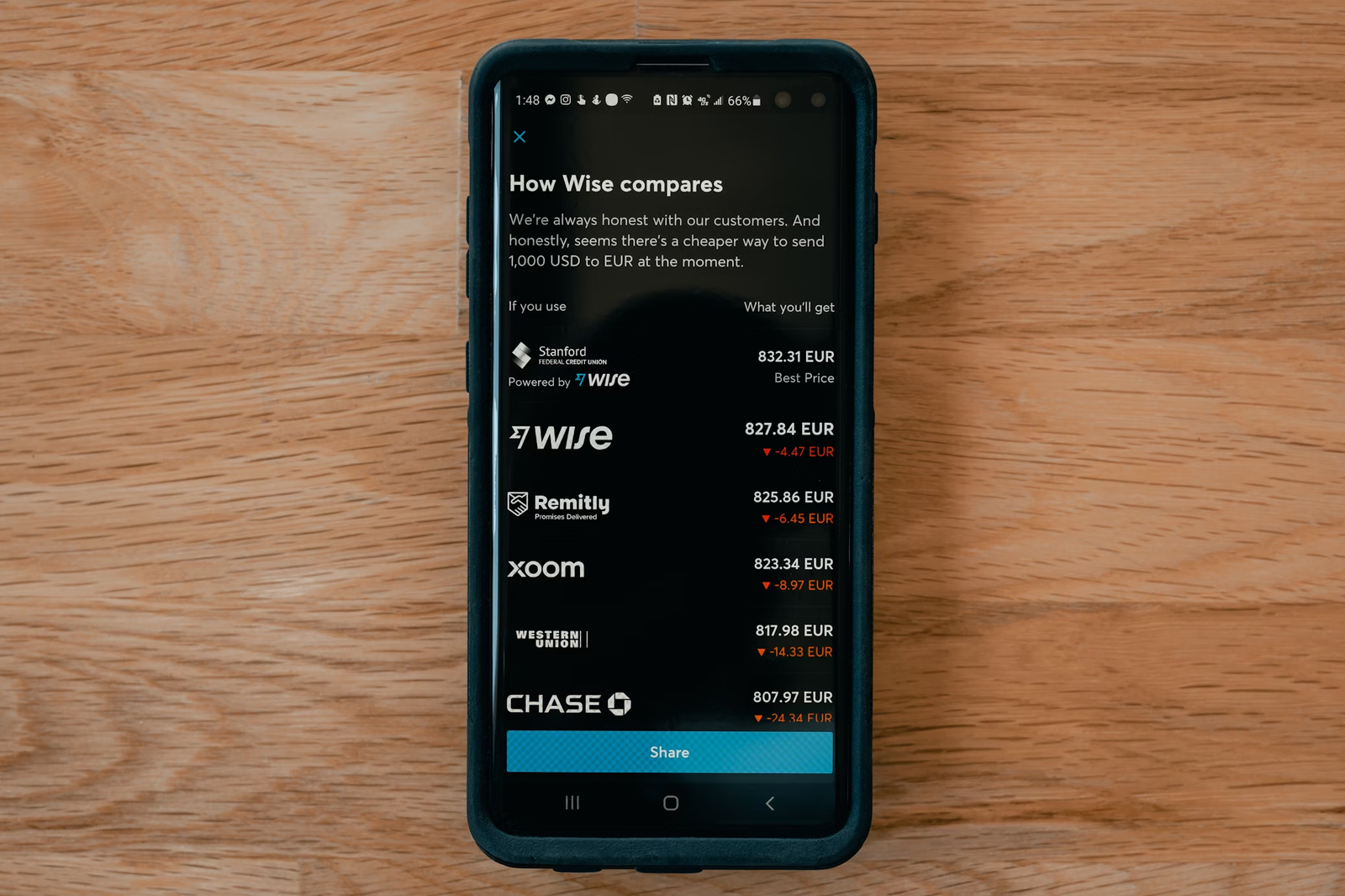

When compared to traditional banks, Wise stands out for its cost savings. Banks generally charge a variety of fees, including service fees, conversion charges, and inflated exchange rates, which can add up to a significant amount, especially for larger transactions. In contrast, Wise provides a breakdown of fees and shows the real-time mid-market rate, allowing users to make informed decisions.

For example, a $1,000 transfer from the US to the UK through a traditional bank might involve $30-$50 in fees, along with an exchange rate markup that could cost an additional $20-$40. The same transfer through Wise would cost only a small flat fee, plus the real exchange rate, saving users anywhere from 3% to 5% on average per transaction.

Wise Borderless Account: An Added Advantage

In addition to currency conversion and transfers, Wise offers the Wise Borderless Account, a multi-currency account that enables users to hold and manage money in multiple currencies simultaneously. This account allows individuals and businesses to receive payments in several currencies without needing a local bank account in each country. For frequent travelers, expats, or businesses operating internationally, this account offers added flexibility and control over finances.

The Wise Borderless Account comes with a debit card that can be used for purchases and withdrawals in different currencies without incurring hefty foreign transaction fees. It also allows users to convert currencies within the account at the real exchange rate, making it an excellent tool for global transactions.

Who Should Use Wise?

Wise is ideal for anyone who needs to send or receive money across borders regularly, including:

- Freelancers and remote workers: Many freelancers work for clients in different countries, and Wise helps them receive payments without losing money on conversion fees.

- Expats and international travelers: Wise offers a cheaper way for expats and frequent travelers to send money to and from their home countries.

- Small businesses: Wise is particularly useful for small businesses engaged in international trade, allowing them to pay suppliers and employees overseas at low fees.

- Individuals sending remittances: People sending remittances to family members abroad benefit from Wise’s low fees and quick transfers, ensuring that more of their money reaches their loved ones.

FAQs

What is Wise Conversion?

Wise conversion refers to the process of converting one currency to another using Wise, a money transfer service formerly known as TransferWise. Wise offers international transfers with transparent fees and uses the real mid-market exchange rate, making it one of the most cost-effective ways to exchange currencies. It is widely used by individuals, freelancers, and small businesses for converting money across different countries and currencies.

How does Wise conversion work?

Wise conversion works by leveraging local transfers rather than international bank transfers. When you send money through Wise, the platform matches your transfer with someone else transferring the opposite currency. This means that instead of sending money across borders, Wise uses its local accounts in different countries to distribute the funds. As a result, the process avoids high international transfer fees, offering users a cheaper and faster option for currency exchange.

What is the mid-market rate Wise uses?

The mid-market rate, also known as the real exchange rate, is the fairest currency exchange rate available, representing the midpoint between the buying and selling prices of currencies on the global market. Wise uses this rate for currency conversion without inflating it, unlike many traditional banks and money transfer services that add a markup. This transparency ensures users get the best value for their money.

What are the fees for Wise currency conversion?

Wise charges a small, transparent fee for currency conversion, which varies depending on the amount and currencies involved. These fees are generally much lower than traditional banks or other money transfer services. Wise clearly displays the total fee before completing a transfer, so users know exactly how much they are paying upfront. There are no hidden fees or additional costs after the transaction.

How long does Wise conversion take?

The time it takes for Wise conversion to be completed depends on several factors, such as the currencies involved, payment method, and the country you are sending money to. In many cases, transfers are completed within a few hours or up to two business days. Wise provides updates and notifications throughout the process, so users can track the status of their transfer in real-time.

Is Wise cheaper than traditional banks for currency conversion?

Yes, Wise is often significantly cheaper than traditional banks. Banks usually charge higher fees for international transfers, including hidden fees and inflated exchange rates. Wise offers lower, transparent fees and uses the mid-market exchange rate, making it a more affordable option for sending money abroad or converting currencies.

Can I hold multiple currencies in my Wise account?

Yes, Wise offers a multi-currency account, known as the Wise Borderless Account. This account allows users to hold, manage, and convert money in more than 50 currencies. It is a convenient solution for frequent travelers, freelancers, and small businesses who deal with multiple currencies. The account also comes with a debit card, allowing users to spend or withdraw money in different currencies without incurring high foreign transaction fees.

What currencies does Wise support for conversion?

Wise supports over 50 currencies, allowing users to convert and transfer money to more than 80 countries worldwide. Some of the most popular currencies supported include USD, EUR, GBP, AUD, and CAD. Whether you’re sending money to a friend, paying an international invoice, or managing multi-currency business accounts, Wise provides a comprehensive range of currencies for smooth transfers.

Conclusion

Wise has revolutionized the way individuals and businesses handle currency conversion and international money transfers. With its transparent fee structure, use of the real exchange rate, and fast transfer times, it has become a go-to solution for people seeking an affordable alternative to traditional banks. Whether you’re paying international invoices, sending money to family, or managing multi-currency funds, Wise offers an efficient, cost-effective solution that continues to grow in popularity worldwide.

To read more, Click Here.